aliyaOS™ orchestrates every function in the lending lifecycle, from borrower intake to credit decision, funding to syndication, and performance oversight. One ‘always on’ system. Zero manual work. No disconnected tools.

+ Built for enterprise

Enterprise-grade governance, scale, and compliance.

+ Driven by intelligence.

Real-time, data-first decisioning across the lending lifecycle.

+ Designed

for precision.

High-fidelity model. Risk-first pricing. Instant fulfillment.

aliyaTransact™

AliyaTransact is the cash-flow intelligence engine within AliyaOS. It analyzes live DDA and transaction data to understand how consumers actually earn, spend, and save — giving lenders a real-time, forward-looking view of affordability rather than a backward-looking credit score.

- Turns raw transaction data into actionable credit intelligence.

- Enables instant, accurate risk pricing and auto-origination.

- Expands credit access for strong borrowers with limited FICO history.

- Reduces losses and volatility through true cash-flow-based underwriting.

aScore

aScore is AliyaOS’s proprietary residual-cash-flow risk model. It measures a borrower’s ability and willingness to pay, not just historical credit events. aScore evaluates real inflows, outflows, stability of income, and recurring obligations to predict future performance with exceptional accuracy.

For lenders, aScore identifies prime-quality borrowers hidden within sub-prime FICO ranges — unlocking safe growth in underserved segments. It also dynamically re-scores portfolios based on updated transaction behavior, enabling proactive risk management and portfolio optimization.

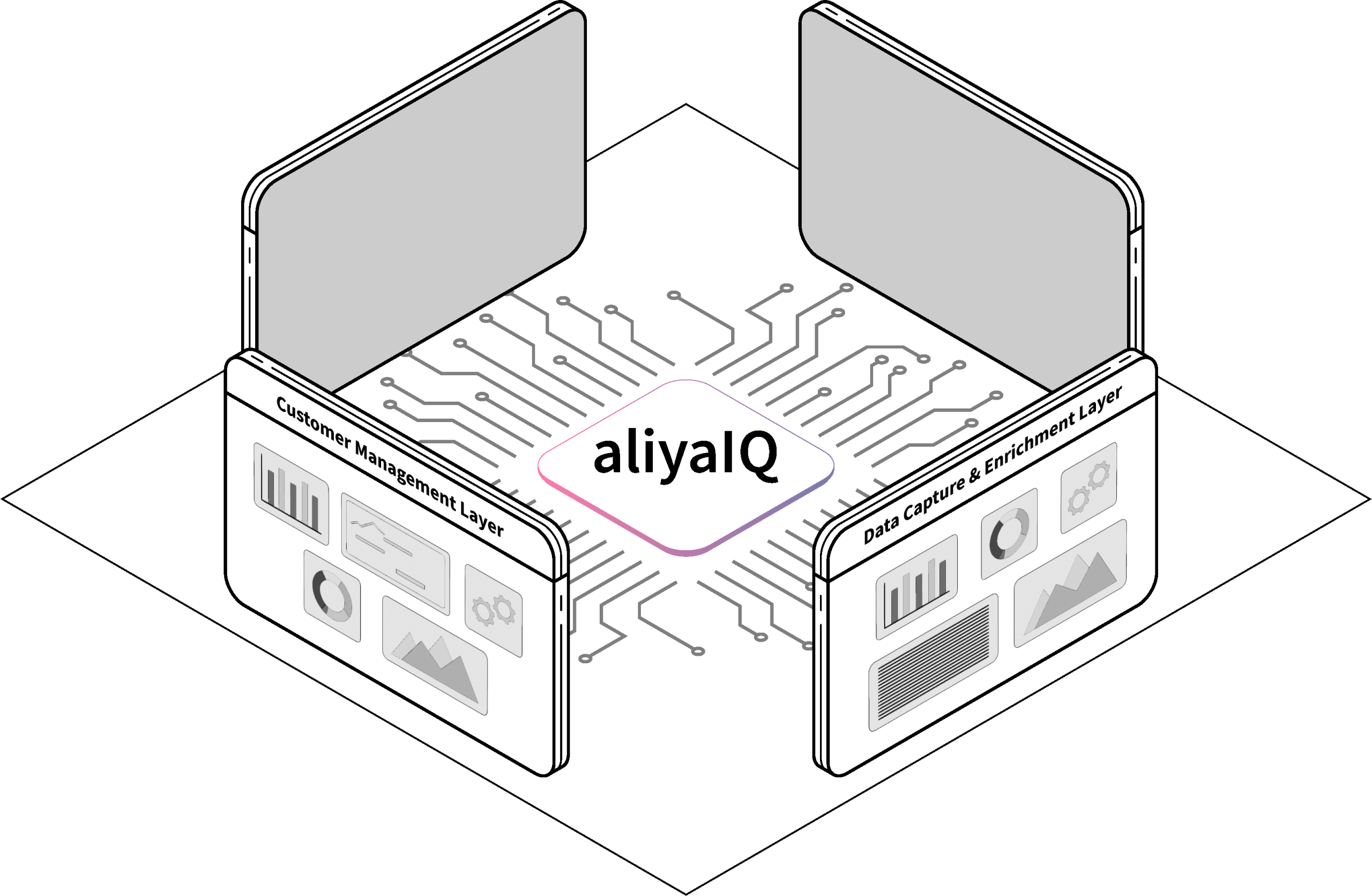

aliyaIQ™

Contiuous intelligence

That guides strategic and regulatory oversight.

Real-time visibility into portfolio performance, marketing efficiency, and capital utilization. Every decision made by the agentic engine — from pricing to funding allocation — is traceable and explainable within AliyaIQ.

- Data Capture & Security

- Intelligence

- Customer & Capital Management

- Command & Control

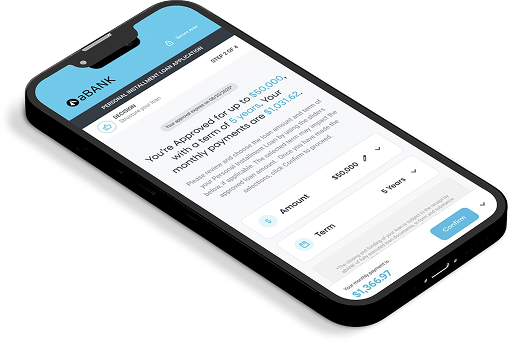

Offer Construction

AliyaOS includes a dynamic offer-construction engine that generates personalized, risk-based credit offers in real time. Using transaction-level insights from AliyaTransact and aScore, it determines eligibility, price, and terms instantly — enabling pre-approved offers through digital and branch channels.

Banks can deploy precision marketing campaigns with compliant, data-driven offers that convert at higher rates and strengthen customer loyalty, all while maintaining auditability.

Deploy in weeks

No Core System Integration Required.

Aliya’s plug-and-play platform is built to deploy fast and scale securely.

From onboarding through workflow design to go-live, the system can be operational in under four months with full support across risk, compliance, and technology teams.

Built for trust.

Compliant by design.

aliyaOS™ meets the most rigorous global standards for data protection, availability, and privacy to ensure every decision is secure, auditable, and compliant.

From infrastructure to daily operations, security is foundational to aliyaOS™. We align with leading regulatory frameworks, maintain strict internal controls, and proactively manage risk across every layer in the system.

- SOC 1 Type II and SOC 2 Type II

- ISO 27001

- Data Encryption

- Threat Detection

- Information Security