Built for revenue.

Powered by AI.

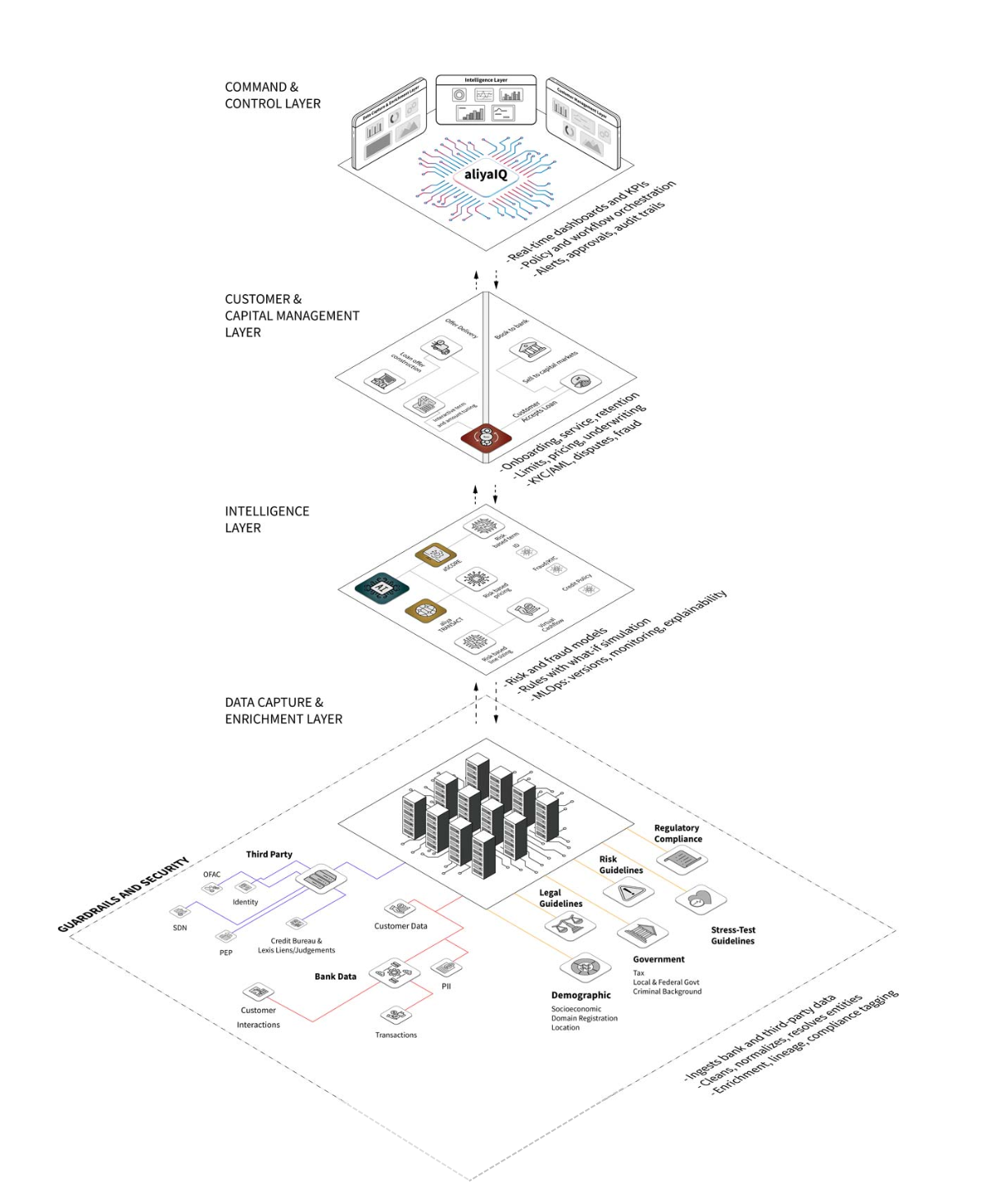

Our flagship platform, aliyaOS™, transforms how banks lend by turning fragmented processes into a single, fully autonomous system.

Designed for modern lending.

LIVE with a top 5 U.S. Bank since 2018.

Our flagship platform, aliyaOS™, transforms how banks lend by turning fragmented processes into a single, fully autonomous system that integrates data, decisioning, risk management, and capital markets. It operates 24/7 with zero human intervention, helping financial institutions grow deposits, reduce losses, and scale lending profitably — with enterprise-grade governance.

aliyaTRANSACT™

Categorizes transactions with 99% accuracy, providing unmatched visibility into affordability at application.

Explore aliyaTRANSACTaScore™

measures a borrower’s ability and willingness to pay, not just historical credit events.

Explore aScoreOffer Construction

Dynamic offer-management that generates personalized, risk-based credit offers in real time.

Explore Offer ConstructionaliyaIQ™

Real-time visibility into portfolio performance, marketing efficiency, and capital utilization.

Explore aliyaIQWhy Aliya?

Aliya builds category-defining agentic AI that transforms how banks serve customers — delivering liquidity, managing risk, and driving safe, profitable growth with dynamic capital management. By combining transaction data, credit bureau insights, and proven, well-governed AI with smart infrastructure, Aliya reimagines the way liquidity is provided.

AliyaOS, built for banks and financial institutions, uses agentic AI to re-engineer lending. It ingests and enriches hundreds of data points that are fed into two powerful AI agents to provide risk-adjusted pricing, sizing and term. This produces a risk-adjusted return that is 4X higher than traditional lending processes. AliyaOS transforms unsecured lending into a 5% ROA asset class while operating within full governance and compliance frameworks.

AliyaOS includes a dynamic offer-management engine that generates personalized, risk-based credit offers in real time. Using transaction-level insights from AliyaTransact and aScore, it determines eligibility, price, and terms instantly. Loan approvals complete in five minutes or less and loans fund in under an hour.

Aliya-enabled portfolios deliver approximately 5% ROA after losses and 13% yield net of losses, while reducing cost of production by 90%. Average loss rates are 2–3% with a 0.9% standard deviation — roughly one third the volatility of traditional bank portfolios. Loans fund in under an hour and approvals complete in five minutes or less.

AliyaOS has been in continuous production with a top-five U.S. bank since 2018. It supports lending portfolios that run 24/7, processing thousands of transactions daily under strict OCC and internal audit standards. This isn’t a proof of concept — it’s a proven operational system.

Automates. Engages. Generates Revenue.

5%

ROA yields

~13%

Yields of net losses

90%

Reduction in

cost-to-serve

96%

Loans fund in under 60 minutes

Whitepapers

Lead with Lending

Agentic AI delivers 5× ROA and redefines the risk-return frontier for banks.

Read WhitepaperAI in Banking: From Hype to Operational Impact

How unsecured lending can become a bank’s most profitable business line.

Read WhitepaperAI’s Impact on Banking Jobs

How agentic automation shifts staff from risk execution to strategy and oversight.

Read WhitepaperWho We Are

Aliya was founded by a team of banking, risk, and AI leaders who saw that banks were losing their most profitable lending categories to fintechs that used the banks’ own data against them. Since 2018, the Aliya team has built, deployed, and operated its platform within a top-five U.S. bank — proving that lending can be fully autonomous, compliant, and consistently profitable.